Cost Inflation Index is used for computation of long term capital gain/ loss from the sale of assets such as property, gold, shares, bonds etc. While calculating applicable capital gain tax, the index is used to reduce inflationary gains which eventually reduces the income tax liability.

What is Cost Inflation Index?

The value of an asset generally increases over long term. For eg. a property purchased in 2014 would normally cost more than it would have in 2007. However, the increased value also includes a factor of inflation. So, while calculating real profit from the sale of an asset (Capital Gain), we need to adjust the cost of acquisition of property and cost of improvement to factor in this inflation. For this purpose, every year Central Government notifies Cost Inflation Index to adjust for inflation the value of assets which are held for more than 36 months.

Notification of Cost Inflation Index

Central Board of Direct Taxes (CBDT) notifies the cost inflation index for a particular financial year after taking into account inflation for previous year.

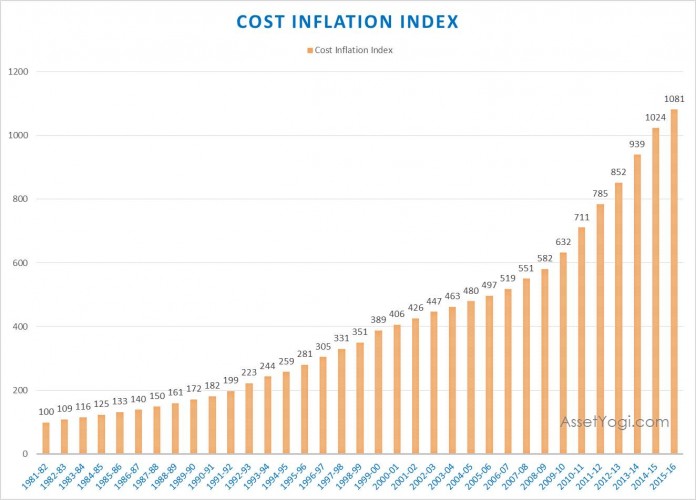

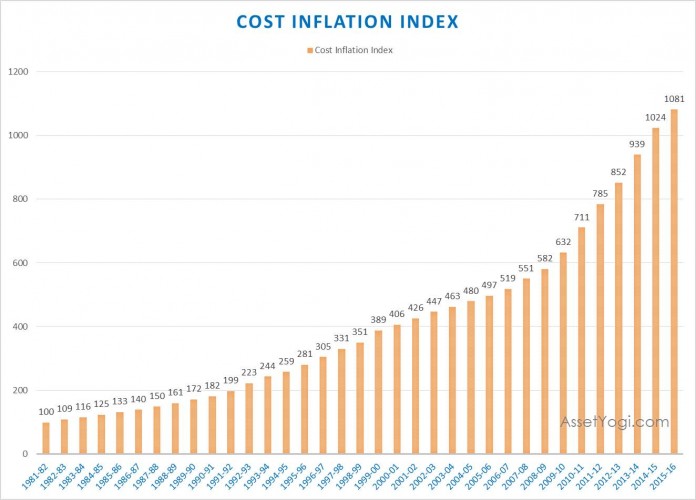

Here is the latest updated list of year-wise Cost Inflation Index or Capital Gain Index from the benchmark year 1981-82 upto 2015-16:

Cost Inflation Index Table (upto 2015-16)

| Financial Year | Cost Inflation Index | Financial Year | Cost Inflation Index |

| Before 1/4/1981 | 100 | 1998-99 | 351 |

| 1981-82 | 100 | 1999-00 | 389 |

| 1982-83 | 109 | 2000-01 | 406 |

| 1983-84 | 116 | 2001-02 | 426 |

| 1984-85 | 125 | 2002-03 | 447 |

| 1985-86 | 133 | 2003-04 | 463 |

| 1986-87 | 140 | 2004-05 | 480 |

| 1987-88 | 150 | 2005-06 | 497 |

| 1988-89 | 161 | 2006-07 | 519 |

| 1989-90 | 172 | 2007-08 | 551 |

| 1990-91 | 182 | 2008-09 | 582 |

| 1991-92 | 199 | 2009-10 | 632 |

| 1992-93 | 223 | 2010-11 | 711 |

| 1993-94 | 244 | 2011-12 | 785 |

| 1994-95 | 259 | 2012-13 | 852 |

| 1995-96 | 281 | 2013-14 | 939 |

| 1996-97 | 305 | 2014-15 | 1024 |

| 1997-98 | 331 | 2015-16 | 1081 |

Cost Inflation Index Chart

How to calculate Cost Inflation Index?

Cost Inflation Index was started in 1981-82 (benchmark year) for which value is assigned as 100. For any property or asset bought before 1st April 1981, the cost inflation index of 1981-82 is used. Then for each year, Cost Inflation Index (CII) or Capital Gain Index is calculated by taking into account 75% of average increase in Consumer Price Index (CPI) for urban non-manual employees for the immediately preceding previous year.

For example, let us calculate CII for 1982-83. Real inflation as per consumer price index (CPI) for previous year (1981-82) was 12%. So the delta increase in CII for 1982-83 would be 75% of 12% i.e. 9%. Therefore, CII for 1982-83 would be 100 (1.09) =109.

Similarly, we can calculate CII for 1983-84 with CPI inflation of 8.563% for 1982-83. Delta increase would be 75% of 8.563% = 6.422%. Therefore, CII for 1983-84 would be 109 (1.06422) = 116.

Calculation of Capital Gain using Cost Inflation Index

In order to calculate capital gain, first you need to calculate indexed cost of acquisition and indexed cost of improvement to remove inflationary gains. Assuming there are no transfer charges, the following formula is used to calculate Capital Gain,

Capital Gain = Sale Consideration – Indexed Cost of Acquisition – Indexed Cost of Improvement

Indexed Cost of Acquisition

Indexed cost of Acquisition is the inflation adjusted purchase price of an asset in the year of its sale. Calculation of indexed cost of acquisition will depend on the type of acquisition.

You can acquire an asset in two ways:

- You purchase the property directly, or

- You acquire the property be means of gift/ succession/ inheritance etc.

Cost of Acquisition for property purchased directly by Assessee

Indexed Cost of Acquisition of an asset that is purchased directly by you is calculated by the formula,

Indexed Cost of Acquisition = Actual Purchase Price * (CII of Year of Sale/ CII of Year of Purchase)

For example, if a property was bought in 2004-05 for Rs. 20 lakhs and sold in the year 2014-15 for Rs. 60 lakhs, the indexed cost of acquisition would be

Indexed Cost of Acquisition = Rs. 20 lakhs * (CII for 2014-15/ CII for 2004-05)

= Rs. 20 lakhs * (1024/ 480) = Rs. 42.67 lakhs

Assuming, there was no cost of improvement,

Capital Gain = Sale Consideration – Indexed Cost of Acquisition

= Rs. (60 – 42.67) lakhs = Rs. 17.33 lakhs

Cost of Acquisition for property not directly purchased by Assessee

If you became rightful owner of an asset by way of gift/ succession/ will/ inheritance etc., no capital gain tax is levied at the time of transfer of such an asset. However, if you further sell the asset after some time, Capital Gains tax would be levied by taking into account indexed cost of acquisition as per the formula,

Indexed Cost of Acquisition = Purchase Price of Previous Owner * (CII of Year of Sale/ CII of First Year of Asset Holding by Assessee).

Example

Mahesh Lal purchased a property in Sep 1983 for Rs. 6 lakhs. He died in May 2001 and the property was transferred to his son Ramnik through inheritance. Fair Market Value (FMV) of the property at the time of transfer was Rs. 15 lakhs. Ramnik sold his property on 20 June 2014 for Rs. 60 lakhs.

Now, let us calculate Capital Gain for Ramnik

Indexed Cost of Acquisition = Purchase Price of Mahesh Lal * (CII of 2014-15/ CII of 2001-02)

= Rs. 6,00,000 (1024/ 426) = Rs. 14,42,254

Let us assume there was no cost of improvement.

Capital Gain = Sale Price – Indexed Cost of Acquisition

= Rs. (60,00,000 – 14,42,254) = Rs. 45,57,746

Indexed Cost of Improvement

Like indexed cost of acquisition, indexed cost of improvement is the inflation adjusted cost incurred in making any modification or improvement to the property. It is calculated by the formula,

Indexed Cost of Improvement = Actual Cost of Improvement * (CII of Year of Sale/ CII of Year of Improvement)

For eg. if in the above example, if Ramnik had also spent Rs. 3 lakhs in the year 2007-08 towards home improvement, calculation of Capital Gain will be as follows:

Indexed Cost of Improvement = Rs. 3 lakhs * (CII of 2014-15/ CII of 2007-08)

= Rs. 3 lakhs * (1024/ 551) = Rs. 5.575 lakhs.

Capital Gain = Sale Consideration – Indexed Cost of Acquisition – Indexed Cost of Improvement

= Rs. (60 – 42.67 – 5.575) lakhs = Rs. 11.758 lakhs

Cost Inflation Index for Properties Purchased before 1st April 1981

For properties purchased before 1st April 1981, cost inflation index of 1981-82 shall be used to calculate capital gain. Accordingly, indexed cost of acquisition and indexed cost of improvement will be taken into account.

Cost of Acquisition

Cost of acquisition for properties purchased before 1st April 1981 shall be taken as Fair Market Value on 1st April 1981. Actual purchase price for such properties has to be ignored because there is no index before 1st April 1981.

Cost of Improvement

For properties purchased before 1st April 1981, cost of improvement would be indexed in the same way as cost of acquisition i.e. any expense incurred in making any modifications before 1st Apr 1981 is to be completely ignored and only expense incurred after 1st Apr is to be taken into account. The reason is that any cost of improvement is factored in the Fair Market Value while calculating indexed cost of acquisition.

An Example

Raghuram purchased a property on 15 Aug 1976 for Rs. 50,000 and sold it on 30 Apr 2013 for Rs. 50 lakhs. He had spent Rs. 5,000 on home improvement in July 1978 and then Rs. 20,000 in May 1994. The Fair Market Value of this property on 1st April 1981 was Rs. 1.5 lakhs.

Capital Gain computation for Raghuram will be as follows:

Indexed Cost of Acquisition = FMV on 1st Apr 1981 * (CII of 2013-14/ CII on 1st Apr 1981)

= Rs. 1,50,000 (939/ 100) = Rs. 14,08,500.

Indexed Cost of Improvement = Rs. 20,000 * (CII of 2013-14/ CII of 1994-95)

= Rs. 20,000 * (939/ 259) = Rs. 72,510

You may notice that actual purchase price of 1976 and cost incurred for improvement in July 1978 are ignored because these are already factored in Fair Market Value of Rs. 1.5 lakhs on 1st Apr 1981.

Now,

Capital Gain = Sale Price – Indexed Cost of Acquisition – Indexed Cost of Improvement

= Rs. (50,00,000 – 14,08,5000 – 72,510) = Rs. 35,18,990

Important Note:

Cost Inflation Index or Capital Gain Index is applied only in case of Long Term Capital Assets i.e. you can calculate your Capital Gain/ Loss using CII only if you have held the assets for more than 36 months from the date of acquisition. For Short Term Assets (held for less than 36 months), benefit of indexation is not applicable.

Over to You

We need your love! Like and Share this article on “Cost Inflation Index”, if you found it useful.

Have something to say or ask? Please comment below.