India is currently witnessing lot of changes not just in economic terms but also in the way society functions. Earlier, in joint families parents could depend on their children for their medical and other financial needs. But in today’s world, young people are working across geographies and many old people are staying alone. They have to take care of themselves. The life expectancy in India is increasing and at the same time cost of medical treatments is also going up tremendously. In this scenario, it becomes really difficult for senior citizens to manage their health and finances. Sometimes, their pension or other income is also not sufficient to manage their monthly expenses. For senior citizens, who have a lack of regular income or financial support from their children, this could lead to financial crisis.

Many of these Senior Citizens live in a house that may have high worth but they are not able to utilize the value of the house. Reverse Mortgage is a product that solves this problem. A Reverse Mortgage Scheme enables a Senior Citizen (above 60 years age) to avail periodic payments from a Bank by mortgaging his house while remaining the owner and occupying the house.

Let us see what is a Reverse Mortgage in more detail and how it works.

What is Reverse Mortgage?

Reverse Mortgage is the opposite of a regular home loan. In a Reverse Mortgage, a senior citizen mortgages his property to a lender (bank), which then makes periodic payments to the borrower so that borrower can meet his monthly expenses. The borrower is not required to make regular monthly payments towards principal and interest to the Bank. During the loan tenure if one of the spouses dies, the other can continue to live in the house until the loan period is over. If however, the borrowers continue to live beyond loan period, they can stay in the house but will not receive monthly payments. Upon the death of both husband and wife, the Bank gives two options to their legal heirs – (1) to settle the outstanding loan and retain the house, or (2) the Bank will sell the house, use the proceeds to settle the outstanding loan amount and handover the balance amount to legal heirs.

Over the loan tenure, although the principal plus accrued interest keeps going up well beyond the initial assessed value of the loan amount but that is easily covered by the increase in home value over time. So, the outstanding loan amount is generally less than the current market value of home. In case, the bank sells the property after death of borrowers and the sale proceeds are less than the total outstanding loan amount, bank will have to bear the loss. It can happen if bank’s original estimation of house value is not in line with current real estate market prices.

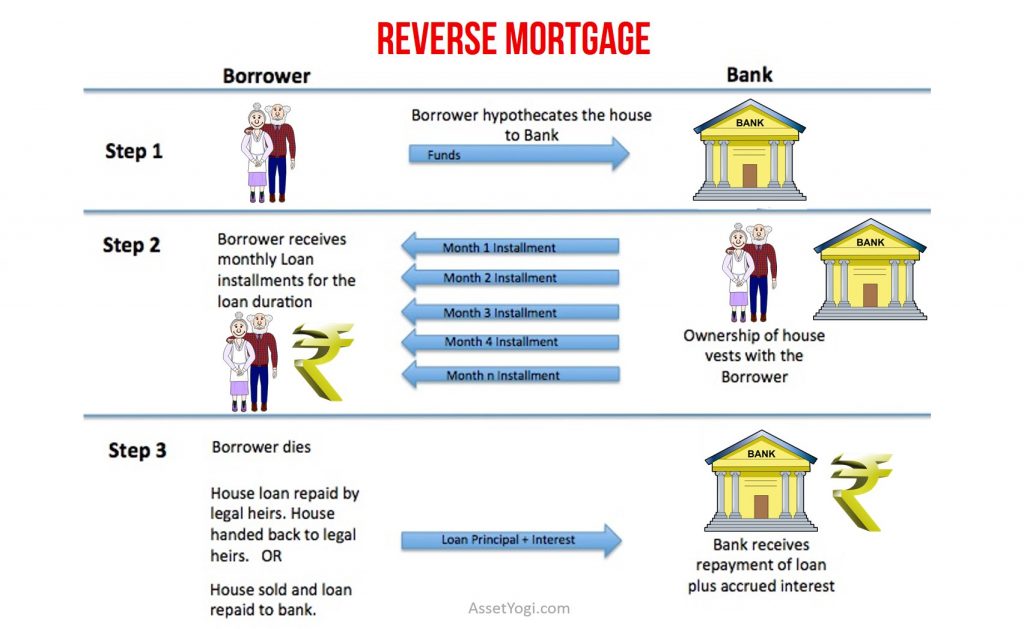

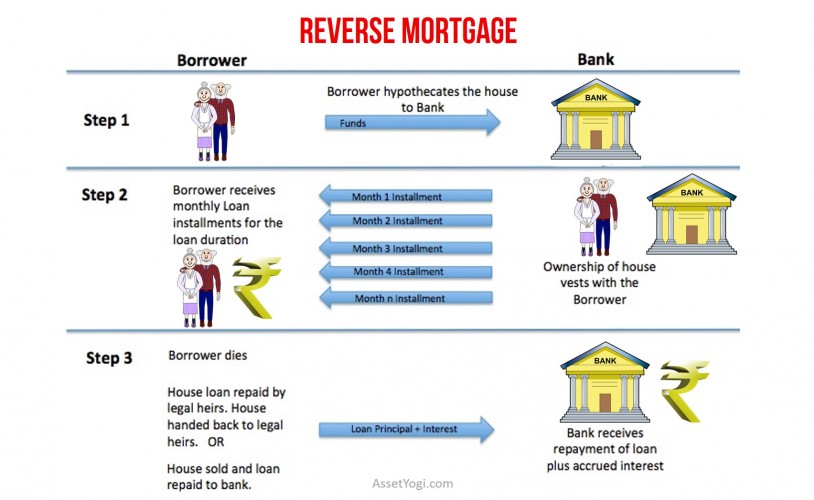

How a typical Reverse Mortgage Works?

How a typical Reverse Mortgage works, is shown in a simple infographic below.

As per NHB guidelines, the borrower is entitled to a loan of 75-90% of the value of the house i.e. a Loan to Value Ratio (LTV) of 75-90%.

Lenders offering Reverse Mortgage:

- State Bank of India (SBI)

- National Housing Bank (NHB)

- LlC Housing Finance

- Punjab National Bank (PNB)

- Indian Bank

- Central Bank of India

- Andhra Bank

- Corporation Bank

- Canara Bank

- Dewan Housing Finance Limited (DHFL)

Reverse Mortgage Loan-Enabled Annuity (RMLeA)

A Reverse Mortgage Loan-enabled Annuity product is an advanced Reverse Mortgage product. In a Regular Reverse Mortgage product, the Bank calculates and makes monthly payments to the borrower directly. While in RMLeA, the Bank makes a lump sum payment to a life insurance company, which calculates the monthly payout, based on actuarial pricing models, that it will pay for lifetime. This monthly payment is called annuity and is typically higher than monthly payouts you would get from a regular reverse mortgage. The insurer is able to give higher payouts because it invests the lumpsum amount and earns returns on it. Because the bank pays in lump sum to the insurer, the interest is levied upfront to the entire amount. Under regular Reverse Mortgage, interest would accrue only on payouts. So, if a borrower dies say within an year, under RMLeA the bank will recover the entire loan amount whereas under the regular Reverse Mortgage, only payouts will be recovered. You should understand both products well, before opting for one.

Companies offering RMLeA

Currently, Star Union Dai-chi Life Insurance Co. Ltd., in association with Union Bank of India and Central Bank, is the only company offering RMLeA products. It offers two kinds of RMLeA products:

- With return of LumpSum – In this, the insurer pays the lump sum back to the bank. In this case, the Bank recovers its principal amount from the insurer and the interest portion is recovered by selling the property or from legal heirs.

- Without return of LumpSum – In this, the insurer will not return the lump sum amount back to the Bank and therefore, the monthly payout is highest in such schemes.

In both cases, the loan amount can be increased if the value of the property increase substantially. As per NHB guidelines, maximum Loan to Value (LTV) ratio allowed is 60% for a 60 year old borrower.

Illustration – Regular Reverse Mortgage vs RMLeA

Rajat Sharma, 60, a retired government servant, owns a property worth Rs. 1 Crores and is willing to take a Reverse Mortgage scheme. His payouts in a regular Reverse Mortgage Scheme and RMLeA scheme are shown in the table below:

- Value of the house – Rs. 1 Crores

- Age of Borrower – 60

- Rate of Interest – 12.75%

| Particular | Regular Reverse Mortgage | RMLeA |

| Payment Period | 20 years | Lifetime |

| Loan to Value (LTV) Ratio | 90% | 55% |

| Loan Value | Rs. 90 lakhs | Rs. 55 lakhs |

| Lump Sum Payment to Borrower | Option of up to Rs. 3,56,126 for medical requirements only | Option of up to Rs. 13,75,000 for medical requirements only |

| Monthly Payment | Rs. 8,218 | Rs. 24,709* |

| Amount to be recovered by the bank upon death of borrower after 20 years | Rs. 90 lakhs | Rs. 6.4 Cr. |

*Monthly payout for RMLeA is calculated assuming the scheme with return of lump sum (Rs. 55 lakhs) i.e. on borrower’s death, the insurer will return the lump sum amount back to Bank. The payout can be even higher in case of without return of lump sum scheme.

Salient Features of Reverse Mortgage

1. Tax Benefits – Payouts from both regular Reverse Mortgage and RMLeA are tax-free in the hands of the borrower.

2. Eligibility Criteria –

- To apply for Reverse Mortgage, the applicant should have completed 60 years of age. In case of married couples, one of them needs to be atleast 60 years old and the other should not be less than 55 years old.

- The house should be self-acquired and self-occupied. The property should be permanent primary residence of borrowers.

- Property should have clear title and should be free from any encumbrances.

- Residual life of property should be minimum 20 years.

3. Loan to Value Ratio (LTV) – Maximum loan available in case of a regular Reverse Mortgage is up to 90% of house value and in case of RMLeA, upto 60% of house value.

4. Tenure – For a regular Reverse Mortgage, minimum tenure is 10 years and maximum tenure allowed is 20 years. Whereas RMLeA is provided for lifetime.

5. Disbursements – The loan can be provided through monthly/quarterly/half-yearly/annual disbursements or a lump-sum or as a committed line of credit or as a combination of the three.

6. Maximum Monthly Payment – As per NHB guidelines, the maximum monthly payment is capped at Rs.50,000.

7. Maximum Lump Sum Payment – The maximum lump-sum payment is restricted to 50% of the total eligible amount of loan subject to a cap of Rs.15 lakh, which can be used only for medical treatment for self, spouse and dependants, if any. The balance loan amount would be eligible for periodic payments.

8. Prepayment – Borrowers can pre pay the loan at any time during the loan period without any prepayment charges.

9. Revaluation – The revaluation of the property has to be done by the lender once every 5 years.

10. Eligible End Use of Funds

- Up gradation, home improvement, renovation, maintenance and insurance of house.

- Medical, emergency expenditure for maintenance of family

- To supplement pension/other income

- To meet any other genuine need

Proceeds from Reverse Mortgage Loan cannot be used for speculative, trading and business purposes

11. Foreclosure – The loan could be foreclosed by the lender, if:

- The borrower declares himself as bankrupt.

- The borrower does not stay in the house for a continuous period of more than one year.

- The borrower has not paid property taxes and fails to insure the home.

- The said property is donated or abandoned by the borrower.

- The borrower rents out or sells off part or entire house, or creates any other encumbrances on the property.

- The borrower commits fraud or misrepresentation.

- The government under any statutory requirements, seeks to acquire the property for public use or condemns the property for health or safety reasons.

Situation in India

Though, Reverse Mortgage was introduced in 2007, it has not gained much popularity in India. Some of the reasons for the poor traction can be:

- Unawareness – Most senior citizens in India are not aware of Reverse Mortgage. To spread more awareness, Banks should market their Reverse Mortgage products and educate senior citizens & their children about such products.

- Maximum Limit – Most Banks that provide Reverse Mortgage have capped the loan limit at Rs. 50 laks to Rs. 1 Crore. Some people may have higher monthly expenses which cannot be funded by this limit.

- Society Pressure – In India, home is looked upon as place of worship. If you talk about liquidating your primary home, it is not taken well by anybody especially children. Children see it as giving away their family home and wealth.

With introduction of RMLeA and tax breaks, Reverse Mortgage has been made a more lucrative option. Better marketing and education initiatives will further spread awareness about the product.

Is Reverse Mortgage for you?

Reverse Mortgage may look attractive but in our opinion, it should be the last resort for your retirement planning because indirectly you are liquidating your asset. But if you have no other means to manage your monthly expenses or if you have to depend on others for your expenses, Reverse Mortgage will definitely provide you the much needed oxygen. Many old people in India own properties of high worth and do not have steady stream of income. In this case, Reverse Mortgage is a good option to generate steady monthly income.

Before you opt for a Reverse Mortgage, it is important that you understand the product completely, how you will get your payouts and how the bank will recover its money. A Reverse Mortgage will also change your estate planning, so you must communicate your planning to your children and set expectations of the family.

If you are young and reading this, you should start building assets that can generate enough passive income so that you are always secured and never have to liquidate your asset. Of course, Reverse Mortgage option will always be there in case of an emergency.

What do you think? Would you opt for Reverse Mortgage?

Over to You

We need your love! Like, Share and Rate this guide on “Reverse Mortgage Loan Scheme”, if you found it useful.

Have something to say or ask? Please comment below.